after tax income calculator iowa

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. This Iowa hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

This marginal tax rate means that your immediate additional income will be taxed at this rate.

. 6792000 - 816800 5975200 So. In this tax example. Enter Your Tax Information.

Salary Before Tax your total earnings before any taxes have been deducted. If you make 55000 a year living in the region of Iowa USA you will be taxed 11691. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122.

Enter your gross income. Fields notated with are required. Effective tax rate.

Your average tax rate is 194 and your marginal tax rate is 252. Press Calculate to see your Iowa tax and take home breakdown including Federal Tax deductions. 4292000 - 364050 3927950 So.

Ad Free Tax Calculator. So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Prices to suit all budgets. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

That means that your net pay will be 43309 per year or 3609 per month. Ad Real prices from local pros for any project. If you make 40000 a year living in the region of Iowa USA you will be taxed 7738.

This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20. See What Credits and Deductions Apply to You. However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown.

Our Iowa State Tax Calculator will display a detailed graphical breakdown. Marginal tax rate 24. How to use the advanced Iowa tax calculator.

After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. 40k after tax in Iowa IA Tax Calculator Tip. In this tax example.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds in 2022. The taxes that are taken into account in the calculation consist of your Federal Tax Iowa State Tax Social Security and Medicare costs that you will be paying when earning 4000000. Iowa Salary Tax Calculator for the Tax Year 202122.

So S - F Adjusted Taxable income for Iowa where F Full Federal Tax calculation and S State taxable income for Iowa. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 439-Adjusted Federal Income Tax.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Youll then get a breakdown of your total tax liability and take-home pay. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Enter your annual income in Iowa. Income tax calculator Iowa Find out how much your salary is after tax. Iowa Income Tax Calculator 2021.

How to use the tax calculator. Switch to Iowa hourly calculator. So S - F Adjusted Taxable income for Iowa where F Full Federal Tax calculation and S State taxable income for Iowa.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Our income tax and paycheck calculator can help you understand your take home pay. If you make 25080016 in Iowa what will your paycheck after tax be.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. Iowa State Income Tax. Also known as Gross Income.

439-Iowa State Disability Insurance SDI 000. If you make 143500 in Iowa what will your salary after tax be. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

Did you know you can reduce the amount of tax you pay in Iowa by investing in your retirement. Check the box - Advanced IAS Income Tax Calculator. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Find pros you can trust and read reviews to compare. Your average tax rate is 222 and your marginal tax rate is 361. Confirm Number of Dependants.

Your average tax rate is 213 and your marginal tax rate is 349. Our calculator has been specially developed in order to provide the users of the calculator with. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Switch to Iowa salary calculator. How to calculate income tax in Iowa in. Create Your Account Today to Get Started.

That means that your net pay will be 32262 per year or 2688 per month. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387.

Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the calculator this includes historical tax years which are.

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Income Tax Calculator Estimate Your Refund In Seconds For Free

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Iowa Income Tax Calculator Smartasset

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Withholding For Pensions And Social Security Sensible Money

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

How Is Tax Liability Calculated Common Tax Questions Answered

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Finances And Military Benefits Finance Education Financial Counseling Finance

How To Calculate Basis Points Sapling Calculator Direct Marketing Things To Sell

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

Smartasset S Iowa Paycheck Calculator Shows Your Hourly And Salary Income After Federal State And Local T Retirement Calculator Best Savings Account Financial

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How To Calculate Self Employment Tax In The U S Child Support Calculator Ideas Of Child Support Calcu Child Support Child Support Quotes Birth Photography

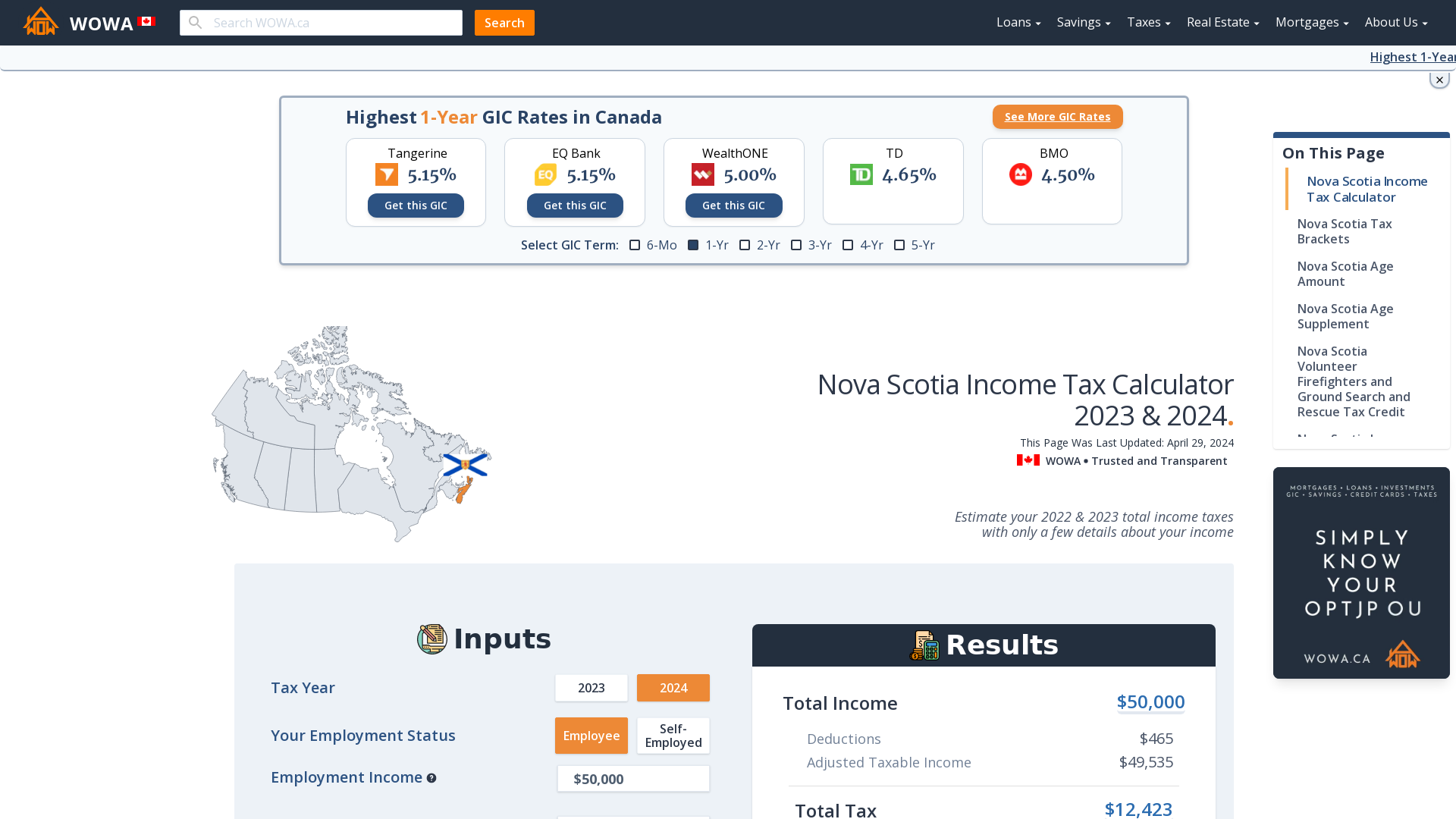

Nova Scotia Income Tax Calculator Wowa Ca

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs